The Surge of CULA: Speeding Towards Success

In an impressive display of growth, Credit Union Leasing of America (CULA) has reported a remarkable 91% increase in active dealer partners just this year. With a strategic focus on expanding its reach across the U.S., CULA has now established a presence in 27 states, including recent additions such as Oregon, Maine, Idaho, and Vermont. The climb to a total of 2,554 dealer partners marks a significant turning point for the company, solidifying its position in the indirect vehicle leasing market.

Cost-Effective Solutions: A Boon for Credit Unions and Customers

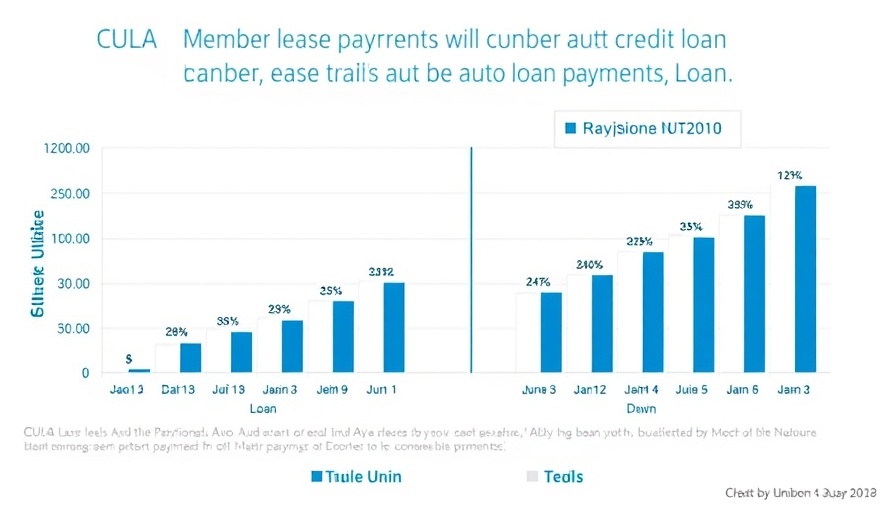

For credit unions partnering with CULA, the real winners are their members, who together saved over $63 million on lease payments in 2024 alone. This translates to average savings of about $159 per month when compared to traditional auto loan payments. Sharon Lobo, chief loan officer at Dort Financial Credit Union, praised CULA's role in diversifying portfolios and boosting yields, demonstrating how pivotal these partnerships are in creating value for members.

Competitive Edge: The Advantages of Partnering with CULA

According to CULA's president, Ken Sopp, partnering credit unions have shown not only substantial savings for their members but have also experienced better financial performance across the board. In 2024, these credit unions reported a loan yield that was 25 basis points higher than non-partnered institutions. Additionally, while overall auto loan growth dropped by 3.62% for some competitors, CULA partners excellently bucked the trend, achieving 2.21% growth, showcasing a resilient and effective business model that thrives even in challenging times.

Addressing Market Pressures: CULA’s Response to Inflation

Analyzing the broader economic landscape, Sopp emphasizes the pressure inflation is putting on auto shoppers. As the average transaction price for autos surged from $36,755 in 2022 to $40,912 in 2024, the demand for affordable leasing solutions has never been higher. CULA sees this as an opportunity for credit unions to step up and provide competitive financial options that can substantially ease the burden on consumers.

The Future Looks Bright: Predictions for 2025

As we look forward to 2025, CULA is optimistic about its prospects, leveraging its data-driven insights to further drive credit union adoption and create cost-effective solutions for its members. Sopp highlighted the potential challenges posed by recently announced tariffs affecting the auto industry, which may lead to even higher vehicle prices, but he remains confident that credit unions have the frameworks in place to adapt effectively and continue to deliver value to their clientele.

In conclusion, as CULA's active partnerships flourish, credit unions stand at the forefront of offering innovative and flexible financing solutions, navigating the complexities of the auto market with agility and foresight. The importance of staying informed and engaged with market developments cannot be overstated for dealership owners and GMs.

Add Row

Add Row  Add

Add

Write A Comment